The VIP resource guide to optimize your guest experience and deliver profitable growth.

We are pleased to share with you our new VIP Playbook. It serves you and your team as an immediate resource, filled with the insights needed most to help you optimize your guest experience and deliver profitable growth.

.webp?width=400&height=400&name=GettyImages-1014251434(In-the-cage-e-check).webp)

For access to complete VIP Playbook resources, please click the button below to submit a user request form using your company email address.

Secured portions of the VIP Playbook are provided solely for merchants and employees currently contracted with Pavilion Payments.

All user requests are subject to review and approval by Pavilion Payments site administrators.

VIP Playbook provides all the resources you need to support your staff and guests for ease of use and maintenance of your Pavilion Payments products.

Access troubleshooting articles, technical guides and maintenance documentation. Use these in collaboration with your Pavilion Payments partners and for training activities with your staff.

Check here for up-to-the-minute product information to support new releases and product launches.

Click on the Learn More link to see technical documentation, maintenance guides, and training materials for all your Pavilion Payments products.

Marketing Tools

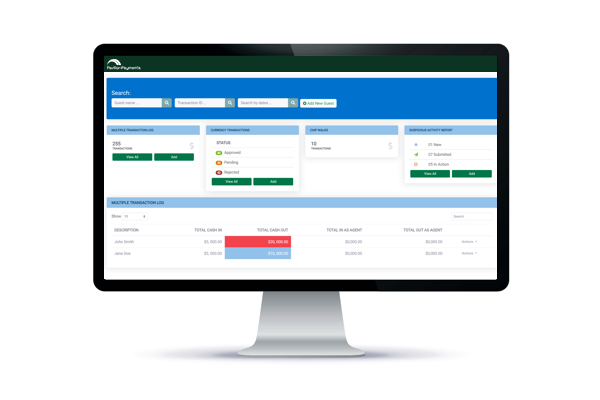

VIP Shield is an open-API solution that can easily integrate with any gaming system. The solution is accessible directly through our VIP LightSpeed® platform and automatically flags transactions for necessary compliance actions and posts MTL, NIL and chip log entries as needed. Additionally, the solution executes SAR and incident reporting as needed.

The effective protection of consumer data requires a multi-layered approach that includes EMV, encryption and tokenization. That’s why our debit and credit card cash advance solution is EMV-ready, and encryption and tokenization are standard — with guest data never passing in the clear.

Available through our VIP LightSpeed® platform, VIP IntelligenceTM makes it easy for cage and finance managers to measure the real-time performance of their credit and debit card cash advance, e-check and more. Clients can easily access transaction and trend data in real time and historical data up to 25 months.